Oil & Gas

EAST AFRICAN CRUDE OIL PIPELINE PROJECT SECURES MASSIVE FINANCIAL INJECTION FROM AFRICAN BANKS.

JUMA SULEIMAN

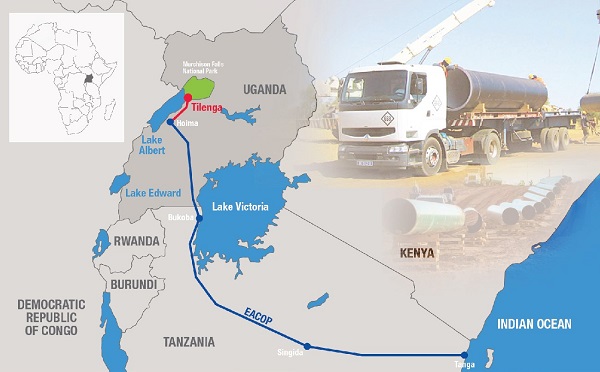

EACOP, responsible for the construction of the East African Crude Oil Pipeline from Uganda to Tanzania, has secured substantial financial support from top African banks. This financial backing marks a significant milestone for the project, demonstrating the confidence of regional banks like Afreximbank, Stanbic Bank, and KCB Bank in this transformative infrastructure venture. This funding will help ensure the timely completion of the pipeline, which is crucial for Uganda’s oil export plans.

The successful closure of the first financing tranche has helped EACOP move forward with construction, with shareholders including TotalEnergies, UNOC, TPDC, and CNOOC. EACOP's progress is crucial to the regional oil industry, connecting Uganda's oil resources to international markets. The project will enhance East Africa’s oil export capacity, and the pipeline, once completed, will have the ability to transport 246,000 barrels of crude oil per day.

The pipeline is being constructed alongside upstream development projects, Tilenga and Kingfisher, and is expected to cost around $4 billion. The financing structure, with an equity to debt ratio of 52:48, highlights the government’s commitment to the project's financial sustainability. The pipeline will include pumping stations, pressure reduction stations, and a solar-powered marine export terminal, ensuring a reliable energy infrastructure.

Construction of the pipeline is progressing well, with over 8,000 local workers employed and a focus on environmental and community standards. The project is set to provide significant economic and employment benefits while adhering to high environmental and social standards. This effort is a critical step toward establishing East Africa as a key player in the global oil market.