Oil & Gas

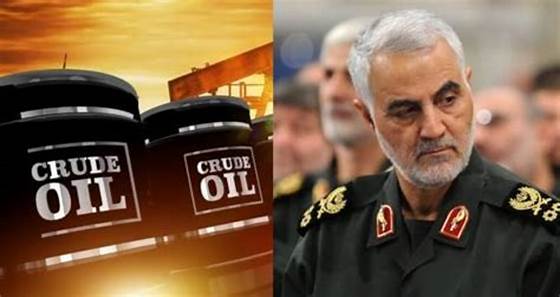

OIL TUMBLES TO OVER ONE WEEK LOWS AS TRUMP ANNOUNCES ISRAEL IRAN CEASEFIRE.

JUMA SULEIMAN

Oil prices plunged to their lowest levels in over a week following U.S. President Donald Trump’s announcement of a ceasefire agreement between Iran and Israel. The move marked a significant de escalation in one of the world’s most sensitive geopolitical flashpoints, easing fears of a broader regional conflict that could disrupt global oil supplies. Brent crude futures dropped nearly 3% to $69.40 a barrel, while U.S. West Texas Intermediate (WTI) fell 3% to $66.48. The ceasefire, which Trump described as “complete and total,” is set to begin with Iran halting hostilities immediately, followed by Israel 12 hours later, with full cessation expected within 24 hours if both sides comply.

From an economic perspective, the easing of Middle East tensions is expected to stabilize global energy markets, which had been rattled by fears of supply shocks following recent U.S. military strikes on Iranian nuclear facilities. The Strait of Hormuz a crucial chokepoint for global oil transit had been under close watch, with investors concerned that any disruption there could push crude prices above $100. The announcement of peace has temporarily reversed that sentiment, with markets now pricing in improved supply continuity from OPEC members, particularly Iran, which is the group’s third-largest producer. Analysts also note that the retreat in oil prices could relieve some inflationary pressures in major economies.

For the business community, particularly energy companies and shipping firms, the ceasefire signals a potential return to normal operations and reduced risk premiums. The news is a double-edged sword, however lower oil prices could pressure profit margins for producers who had benefited from the previous rally. Energy market analysts are now closely watching whether the ceasefire holds, as any breakdown could reignite geopolitical risks. Meanwhile, companies are re-evaluating supply strategies, hedging positions, and capital expenditures based on the evolving outlook in the Middle East and its impact on global demand and pricing dynamics.