Ukraine Crisis Pushes Coal Price High

Executive Summary

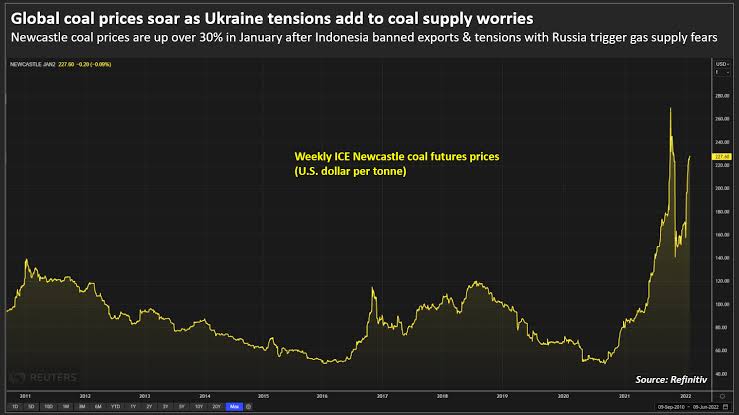

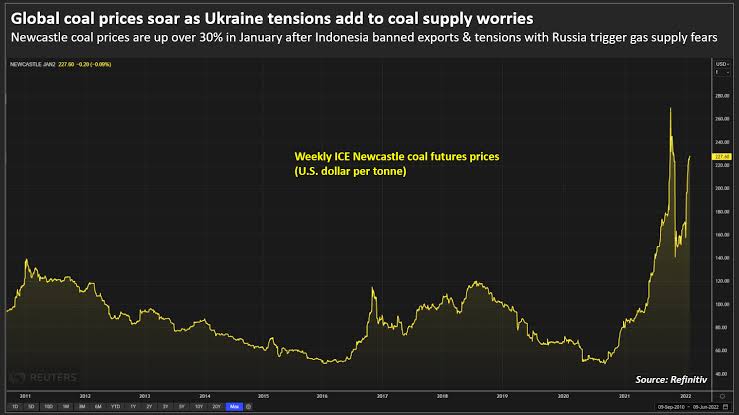

Global coal prices have shot back towards record highs as the Ukraine crisis

Global coal prices have shot back towards record highs as the Ukraine crisis raises expectations that European buyers will start loading up on the fossil fuel for fear that a standoff between Russia and western nations will cut off gas supplies.

The benchmark Newcastle coal index has soared by over a third this month to $262 a tonne, fuelled initially by a month-long export ban by top supplier Indonesia and now by worries that any military engagement in Ukraine will sever gas supplies from Russia.

Europe relies on Russia for around 35% of its natural gas, and has been grappling with a gas shortage since last summer that sent local prices to record highs late last year.

Global coal prices soar as Ukraine tensions add to coal supply worries, Gas prices started to ease in recent weeks as imports surged, but have rallied again as the escalating tensions with Russia raise concerns about a potential supply disruption

To protect themselves from any fuel shortages, European utilities have stepped up imports of coal, further tightening a market that has yet to recover from Indonesia's shock ban that cut coal flows during the peak winter demand season.

"Spot cargoes are becoming scarcer in the near term, with movement towards Europe where prices are jumping due to gas prices and the simultaneous effect of the recent Indonesian ban," said Puneet Gupta, founder of Indian coal marketplace Coalshastra.

While Europe's coal use has declined sharply in recent years - accounting for just 6.2% of global coal use in 2020, according to BP data - European buyers have aggressively stepped up purchases since mid 2021.